- Health Tech Nerds

- Posts

- Weekly Health Tech Reads | 9/24/23

Weekly Health Tech Reads | 9/24/23

FTC lawsuit, State of CareOps report, prescription drug cost data, and more!

NEWS OF THE WEEK

Sharing our perspective on the news, opinions, and data that made us think the most this week

News

Summary: The FTC's complaint here provides a ton of detail on the playbook Welsh Carson used to build US Anesthesia Partners (USAP) into the dominant anesthesia group in Texas. The lawsuit walks through how Welsh Carson initially funded the idea, acquired an anchor provider group in Houston, and subsequently executed on a growth strategy around increasing market share in geographies and used that as leverage to negotiate better rates. The FTC's complaint argues that USAP has been reaping the benefits of monopoly power at the detriment of costing Texans tens of millions of dollars, and is seeking to put a stop to this sort of behavior.

Kevin's Reaction:

As noted in the Slack channel, it doesn't appear in the complaint that Welsh Carson or USAP are doing anything entirely out of the ordinary here. If anything, the case is a good read for folks looking to understand how private equity firms think about this playbook. On page 26 it talks about how Welsh Carson stood up the business in 2012 with $1 - $2 million in funding, had a team working to identify potential anchor practices, found an ideal group in Houston, bought them, and then started executing on tuck-in acquisitions from there. It all seems like a pretty routine way PE groups have historically made money by rolling up care delivery. It's also not just PE groups who do this by the way, it's the playbook really for any organization seeking to reap the benefits of scale in healthcare. I was struck at some of the similarities between this case and the antitrust case filed against Jefferson Health by a local independent oncology group. The basic premise there was the same - if you buy up enough providers in a local market, you can use that dominance to negotiate better deals since you're the only game in town. While it's easy to vilify private equity as a bad actor in a scenario like this, I'm not so sure that's the right confusion. Seems like they're playing the same game as everyone else, just perhaps a little more astutely from a financial perspective. Of course, the depressing part of this is that the only thing that's really clear to me in a case like this is the people of Texas are paying more money for their healthcare as a result of this behavior, which seems less than ideal.

The State of CareOps Report 2023

CareOps, an initiative by Awell in collaboration with HTN, released the second edition of The State of CareOps Report. Drawing from the insights from +250 folks working in product, clinical, engineering or care operations roles, the report aims to provide visibility on how organizations apply CareOps and to help them benchmark performance versus peers.

The insight that surprised us the most? That we’re seeing a marked improvement in CareOps practice for a core group of high performers while the pack is getting bigger, but also lagging further behind.

For the first time, the State of CareOps report also provides benchmarks on key industry metrics such as average utilization rate, % of asynchronous care, and provider time spent on non-clinical tasks. It's a must read for anyone working in care delivery.

CareOps will be hosting a panel with leaders from Thyme Care, Herself Health, Inbound Health & Mindler to dive deeper into the results on 9/27 at 3pm ET. Be sure to register in the link below!

CHART(S) OF THE WEEK

Sharing a visual or two from the week that made us think

Source: Unraveling the Drug Pricing Blame Game, 3 Axis Advisors

Bryce Platt's Reaction:

Bryce Platt, PharmD is a Clinical Specialist at actuarial consultancy, Milliman. Prior to joining Milliman, he worked as a pharmacy consultant and clinical pharmacy specialist at various healthcare organizations. He shares his overview of the report's findings:

Pharmacy supply chain research firm, 3 Axis Advisors is shedding light on the factors influencing prescription drug costs in the US. Their recent study looked at over 32 million retail pharmacy claims from pharmacies in 2020. Historically, the general consensus of most of the American public has been to blame drug manufacturers for high drug costs. However, this report provides a more nuanced look into the control drug manufacturers have on the sticker prices that patients see.

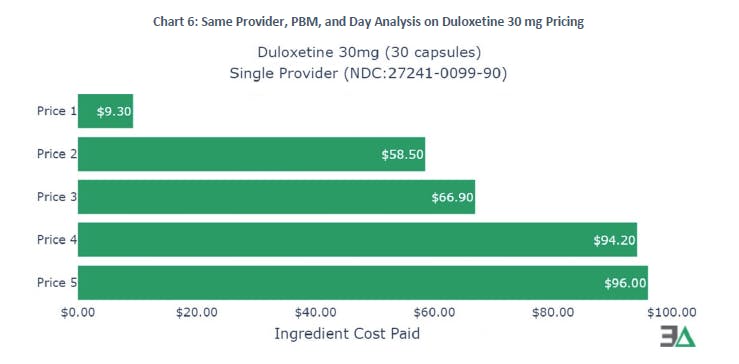

The big takeaway is that generic drug prices are highly variable and completely disconnected from any list price the drug manufacturer may set, with the primary determinant of those prices paid at pharmacies being pharmacy benefit managers (PBMs). In one shocking instance illustrated in the chart above, the reimbursement to the same pharmacy, on the same day, for the same NDC of duloxetine (a cheap generic medication), at the same quantity, from the same PBM, varied in cost significantly - ranging from $9.30 to $96.

Source: Addressing Social Needs through Medicaid - Lessons from Planning and Early Implementation of North Carolina's Health Opportunities Pilots

In 2019, the North Carolina Department of Health and Human Services (NC DHHS) launched the Healthy Opportunities Pilots, an initiative aimed at testing the impact of offering a range of non-medical interventions, such as housing, food, transportation, and safety resources to Medicaid enrollees across the state. The program - originally awarded $650 million from CMS under NC's Section 1115 Medicaid Demonstration - kicked off in 2021 in three regions of NC.

This report recently published by Milbank and Duke Margolis Center for Health Policy evaluates the impact the pilots have had on the populations thus far - discussing six key implementation and policy themes identified, along with recommendations for the program's future next steps.

OTHER NEWS

A round-up of other newsworthy items we noticed during the week

Nonprofit health system, CommonSpirit announced it is launching a value-based care management platform to help independent and employed physicians move to VBC arrangements. The system currently manages 2.6 million patients in VBC payments, which includes 10 ACOs. With the launch of the new platform, CommonSpirit aims to acquire new provider clients looking to move into VBC arrangements.

Link

Two health systems, Promedica and Adventist Health, have decided to shut down their hospital at home programs according to this Beckers report. It prompted an interesting Slack dialogue about the incentives health systems have at play and why these systems might be shutting down these programs despite the seeming tailwinds behind hospital at home.

Link / Slack (h/t Jim St. Clair)

The US Department of Health and Human Services announced a new $45 million grant program to expand access to care for patients suffering from long COVID.

Link

UpHealth, a digital health company that went public via SPAC in 2021, is filing for bankruptcy after a judge forced it to pay the $31 million fee it owed its investment bank as part of the SPAC transaction.

Link

America Physician Partners, a PE-backed emergency department staffing firm, filed for bankruptcy this week.

Link / Slack (h/t Sina Haeri)

It's been a good week for the state of Medicaid expansion in the US - with North Carolina announcing it is on track to expand Medicaid in the state following approval of the budget. Further, the governor of Kansas launched the state's 2024 Medicaid expansion campaign this past week.

FUNDING

A collection of notable startup financing rounds across the industry

Employer health admin platform, Take Command, has raised $25 million in growth equity funding to expand its GTM strategy, enhance payment functionality of platform, and grow its new marketplace offerings.

Link / Slack

CardioOne, Redesign portfolio co, secured $8 million in financing. The company is building a cardiology care management platform aimed at helping independent cardiologists transition into the VBC space.

Link / Slack

Awell raised $5 million in Seed funding to grow its CareOps platform - accelerating product development and continue expansion of work in the US market.

Link / Slack (h/t David Kolacny Jr.)

Digestive health startup, Vivante raised $31 million in Series B financing. The company plans to use the fresh funds to enhance tech upgrades and offer holistic virtual care for digestive health disorders.

Link / Slack (h/t Blake Madden)

VBC enablement platform, Inbound Health secured $30 million in Series B funding to grow into new markets and expand its offerings in the at-home acute and post-acute care space .

Link / Slack

Corti, an AI-copilot for clinicians, raised $60 million. The company reports is works with 100 million patients per year and claims it helps clinicians to be 90% faster in executing their administrative tasks.

Link / Slack (h/t Samir Unni)

Clinical trial platform, Mural Health secured $8 million in Seed funding. The startup reports it currently works with 3 of the top 15 pharma cos, as well as several biotech orgs.

Link / Slack

Amenities secured $10 million in Series A financing to accelerate adoption of its digital front door platform.

Link / Slack (h/t David Kolacny Jr.)

Digital therapeutics startup, HelloBetter raised $5.3 million to scale its suite of evidenced-based mental health products.

Link

Briya, a blockchain-enabled data exchange platform, raised $11.5 million.

Link

WRITERS GUILD

A round-up of posts from the broader healthcare community this week that made us think

Commercializing AI in Healthcare: The Jobs to be Done by Jay Rughani, Daisy Wolf, Vijay Pande, and Julie Yoo

Another solid article from the a16z team digging into the most viable use cases for AI in healthcare, which were derived from a series of interviews with health system and payor C-suite execs.

September 2023: How to build sustainably differentiated tech enabled healthcare services businesses by Ayo Kunle

This was an interesting read about building care delivery models, with an astute hypothesis arguing that innovations in reimbursement, operations, and patient acquisition correlate more highly with success compared to those on the clinical side.

A Data Driven Analysis of 3 Local Healthcare Markets by Michael Stratton

This article includes some really interesting data on physician market dynamics across Atlanta, Orlando, and Phoenix. It digs into 4 main areas of provider dynamics: 1) referral source concentration, 2) health system concentration and facility options, 3) provider consolidation by service line, and 4) in market services.

Reply