Sponsored by: American Heart Association

Less than two weeks remain to apply for American Heart Association’s EmPOWERED to Serve Business Accelerator. Now through June 28, founders of health equity-focused startups can apply for the program.

Selected founders receive six weeks of rigorous training and coaching to refine their business model and brand, plus valuable networking opportunities and a chance to vie for non-equity funding totaling $75,000.

Learn more and apply now for this competitive opportunity.

If you're interested in sponsoring the newsletter, let us know here.

NEWS

CMS recalculates Star ratings for all MA plans; allows impacted plans to resubmit 2025 bids

After losing legal battles to SCAN Health Plan and Elevance over how 2024 Star Ratings were calculated, CMS told insurers on Thursday that it will be recalculating 2024 Star Ratings. CMS will use the published 2023 Star Ratings cut points to recalculate scores, which will remove the Tukey outlier issue. Plans that would have received a higher star rating as a result of this will see that bump; plans that would have seen a drop in their rating will not be dinged as a result.

Adding to the chaos at hand, CMS is also opening a window for plans that were impacted by this change to resubmit their 2025 bids by June 28th.

Read CMS’s memo to health plans.

Read WSJ reporting on the decision.

Read Milliman’s white paper on potential impacts. (written prior to CMS announcement)

✍ Going Deeper

What was already a tumultuous bid season for Medicare Advantage leaders just became even more interesting, not just for the plans that appear to have been positively impacted by the change. Presumably, the plans that see a bump will offer more generous benefits to seniors for 2025, and as a result, the competitive landscape in markets may shift slightly.

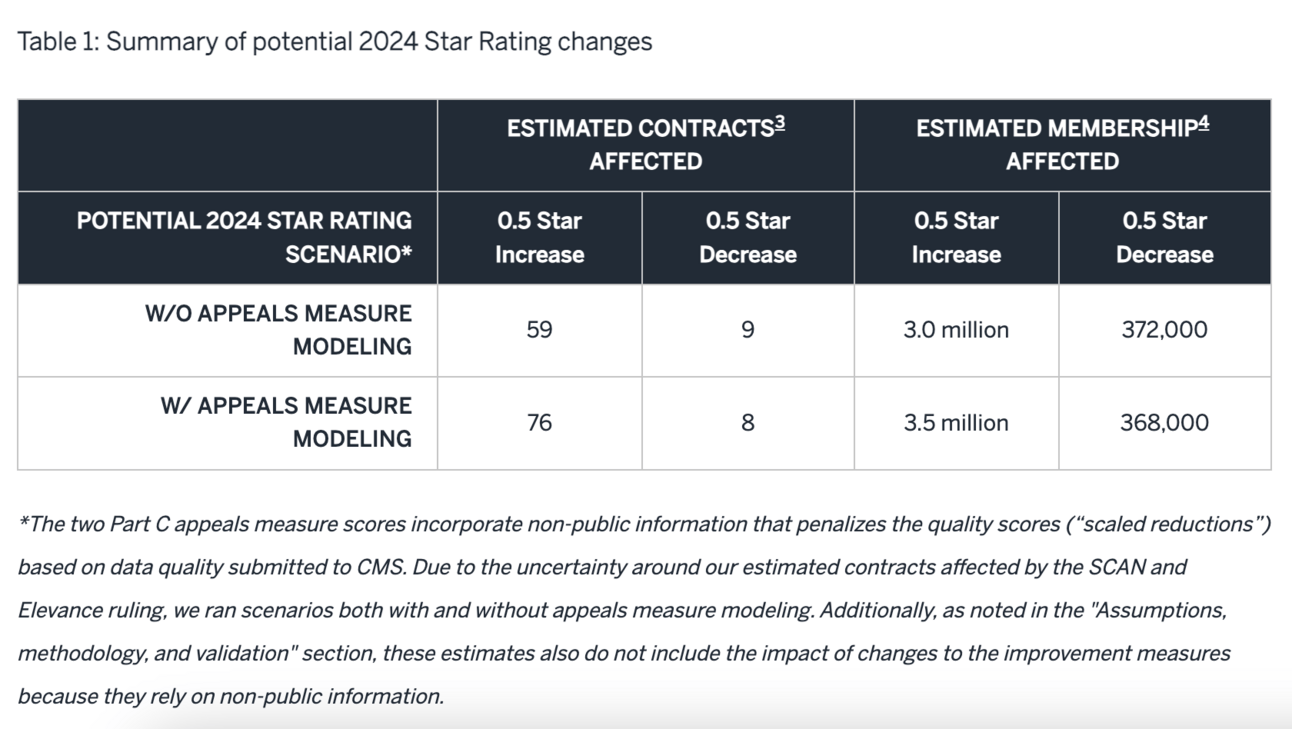

The Milliman paper linked above provided a helpful analysis of what might happen if CMS took this action, highlighted in the chart below. Milliman’s analysis indicates that 60 to 76 plans, representing roughly 3 to 3.5 million members, will see a 0.5 Star increase as a result of this decision:

Note that CMS took the position of not penalizing plans that would have received a 0.5 Star decrease, so those 8 to 9 plans will remain at the same rating.

The Wall Street Journal reported that SCAN leadership expects 60 plans to see a bump from this change, which would potentially lead to an additional $1 billion in quality payments to insurers.

It’s going to be a busy few weeks in the MA plan world for teams scrambling to resubmit bids based on the changes here.

DATA

McKinsey on digital investment priorities

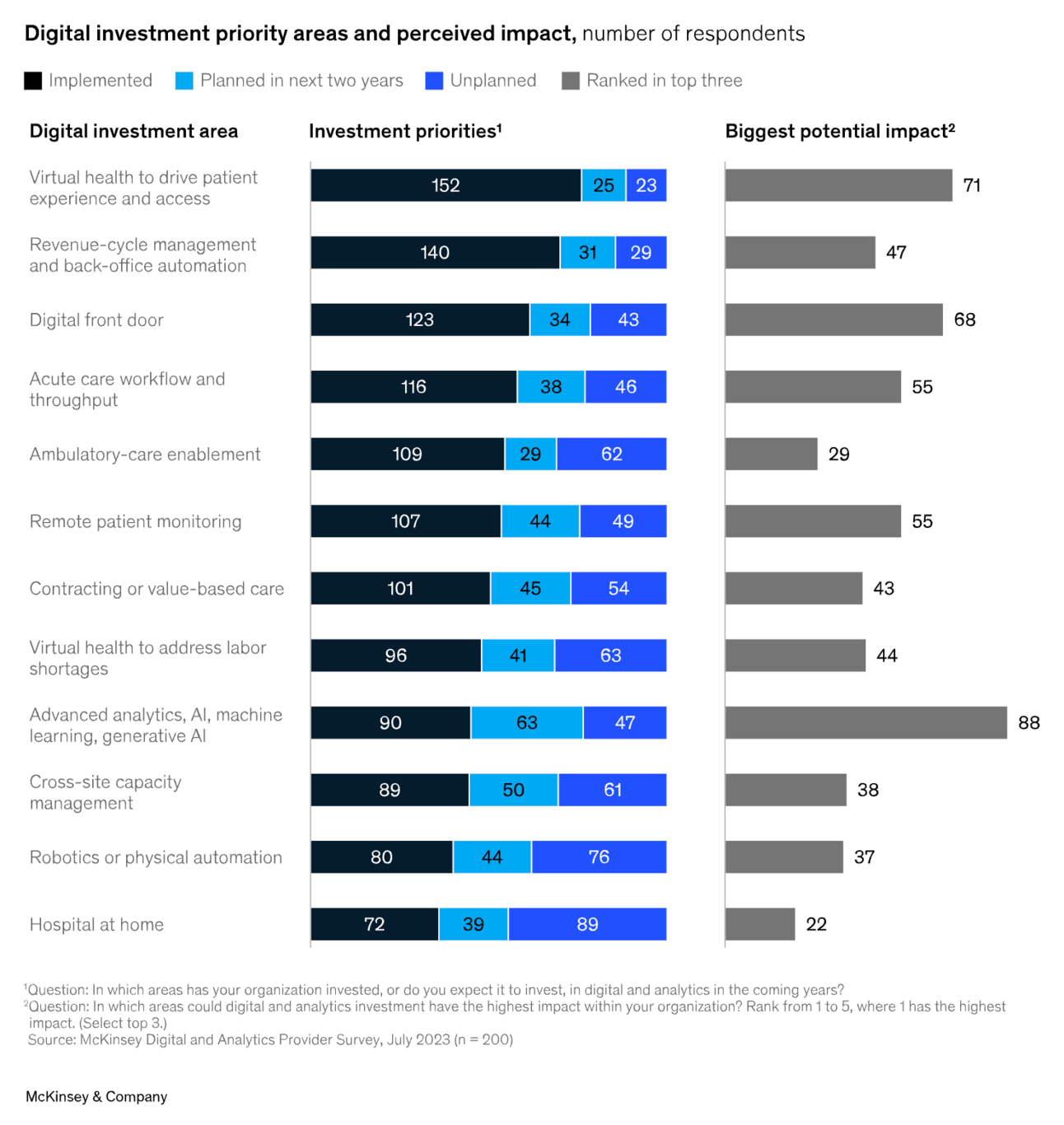

McKinsey shared results from a survey of 200 health system executives looking at their digital investment priorities. The report included several interesting graphics, including this one highlighting the priority level and perceived impact across a number of key themes in digital health:

It’s interesting to see the relative prioritization of these various categories. For instance, hospital at home came in at the bottom, both with the most leaders not having plans to implement it, and also ranking it as the lowest potential impact. No surprise to see AI as having the biggest potential impact, and the most respondents saying its a priority area in the next two years.

It also is worth noting “cross-site capacity management” was called out as the second largest investment priority over the next two years — behind only AI — despite coming in toward the bottom of categories in terms of potential impact.

Other Headlines

The Justice Department and FTC filed an amended complaint against former Cerebral executives, alleging that Cerebral and its former executives violated the FTC Act, the Opioid Act, and the Restore Online Shoppers’ Confidence Act (ROSCA). Cerebral has already settled the claim, but the Justice Department will continue pursuing Cerebral’s former CEO, Kyle Robertson, and his more recent telehealth company.

Two executives from ADHD startup Done were arrested and charged with fraud. The case argues Done made $100+ million in revenue by targeting drug seekers with deceptive social media ads.

CMMI came under fire on the hill this week as Elizabeth Fowler, the Director of CMMI, was questioned by the House Energy and Commerce subcommittee. HealthcareDive did a nice job summarizing the various lines of probing from congresspeople here. Fowler’s written testimony discusses a number of programs CMMI is currently prioritizing.

CalPERS approved two new plan contracts with Blue Shield of California and Included Health. Blue Shield of California and Included will serve ~400,000 CalPERS members, all individuals in self-insured CalPERS PPO plans. The other 1.1 million CalPERS members are covered through other fully insured HMOs. Blue and Included are putting $464 million at risk based on medical cost trends and quality — initially targeting a 5.5% trend in 2025 that is lowered annually until it hits 3% in 2029. Blue and Included will replace Anthem Blue Cross, which has managed the PPO book for CalPERS for over two decades.

CityMD will pay $12 million to settle allegations that it fraudulently billed the government for COVID-19 testing services by submitting false claims showing that people were uninsured when CityMD knew those people had insurance.

Telemental health provider Brightside Health entered the virtual substance use disorder treatment space this week, acquiring Lionbird Recovery.

Tempus AI successfully raised $410 million in its IPO offering, pricing at the top end of the range, valuing the business at $6.1 billion.

Asset managers at JP Morgan have launched a $500 million fund to

Funding Announcements

Anterior, an AI-based automation platform for clinicians, raised $20 million.

Better Health, a platform for medical supplies, raised $14 million.

Canary Speech, a vocal biomarker technology, raised $13 million.

Grayce, a caregiver support platform, raised $10.4 million.

Auxilius, a startup that helps biotech companies manage clinical trial finances, raised $10 million.

Koda Health raised seed funding for advanced care planning.

Good Reads from the Community

Value-based care in nephrology by a Humana team

Humana shared a report on their efforts in the VBC nephrology market, including work with Evergreen Nephrology, Interwell, Monogram Health and Strive Health. It provides a good overview of how and why Humana is attempting to move the specialty care market to VBC, but stops short of sharing much Humana data on results thus far. Read more.

The Role of Design in US Health Systems by a Equitable Healthcare Lab team at the Institute of Design at Illinois Tech

This is an excellent report if you’re interested in how health systems structure design and innovation teams. It surveys 27 big-name health systems and shares many learnings and lessons from how these teams have been built. Read more.

Telehealth Demand: An Update Four Years After the Onset of the COVID-19 Pandemic by Sanjula Jain

A helpful look at the latest telehealth claims data, showing that telehealth visits continue on a downward trajectory. In Q3 2023 there were ~27 million telehealth visits, down from ~60 million in Q2 2020. It’s still a significant increase from pre-pandemic — in Q4 2019 there was ~1 million telelehatlh visits. Read more.

Overcoming Our Misplaced Nostalgia For Traditional Medicare by Sachin Jain

Jain, SCAN Health Plan’s CEO, shared a perspective advocating for a “major reboot” of the Medicare program. His suggestions include: doing away with fee-for-service, eliminating annual enrollment cycles, changing the benefit design process, and reducing utilization management. It’ll be interesting to see how the conversation about Medicare unfolds in this political cycle. Read more.

More from Health Tech Nerds

Exclusive to premium subscribers

Oscar Health's 2024 Investor Day. A deep dive on key themes and lessons learned from Oscar’s Investor Day, including ACA growth, the ICHRA market opportunity, and the role of Oscar’s tech platform.

Community Brain Trust Highlighting the past week’s most helpful conversations from the HTN Community including: Parental leave policies at seed stage companies, nurses & AI, and monetizing health records.

Featured Jobs

SVP, Evolent Primary Care at Evolent Health, a specialty care management solution for payors. Learn more.

Managing Director, Transforming Health and Healthcare Systems at Robert Wood Johnson Foundation, a foundation working to achieve health equity. Learn more.

Chief Medical Officer, Population Health at Curana Health, a value-based primary care provider for senior living facilities. Learn more.

Product Leader at Clarity Pediatrics, a pediatric model for ADHD treatment. Learn more.

Head of Sales at Stedi, an API-first clearinghouse. Learn more.

Contact us to feature roles in our newsletter.