- Health Tech Nerds

- Posts

- Weekly Health Tech Reads | 10/1/23

Weekly Health Tech Reads | 10/1/23

Transcarent's independent provide ecosystem, Elevance pauses merger, out-of-pocket gender gap, and more!

NEWS OF THE WEEK

Sharing our perspective on the news, opinions, and data that made us think the most this week

News

Summary: Transcarent, a care navigation platform for employers, announced it is launching a national independent provider ecosystem with 10 major health systems. This includes the likes of Atrium Health, Hackensack Meridian Health, Mass General, and Mount Sinai, among others. In partnership with the health system network, Transcarent will offer its comprehensive care model via virtual and in-person care to employers across the US.

Ryan's Reaction:

This feels like the natural next step for Transcarent (and other navigators) who have spent years learning how to a) sell to employers a relatively broad suite of services and b) engage employees across that broad suite of services alongside health plans / TPAs, in becoming those health plans / TPAs. Particularly when selling to larger, self-insured employers, having an open access (PPO style) option for members is really important to those employer benefits teams (distributed workforces, different prices sensitivities across worker populations, etc.). I’d imagine going the large health system, broad geographic coverage route has a lot to do with creating a better value proof point than the virtual offerings for those employers that Transcarent has been pitching. It feels a lot like they are reversing into what large health plans / TPAs have historically done: Build network → Add convenience services and ancillary benefits → Add employee navigation on those services and network.

It's worth noting in the press release when discussing 'direct contracting' that they stop short of saying there will be transparent or fixed prices for members and instead mention “transparent information”. If it’s not fundamentally changing the member experience from a pricing perspective, that feels like a miss. Though it very well could be and it’s just not clear in the press release.

I’m guessing a couple of the common questions they’ll be getting from the employee benefits prospects pitching will be: 1) how does my employee’s experience actually change for say delivering a baby, or a broken arm, from the point of finding a provider through delivery of care and payment? Assuming they currently have access to these health systems with their current health plan, will they actually know what they’ll pay ahead of time under Transcarent? and 2) How should I think about this relative to my other health plans? Are members that select this still on one of our other health plans? (This would also then be related to the shared savings / at-risk components).

HTN Slack Convo (h/t Maria Thomas)

News

Summary: Elevance Health announced it will pause its $2.5 billion bid to purchase Blue Cross Blue Shield of Louisiana following pushback from lawmakers over concerns of the deal resulting in higher prices for patients. A report filed with the department of insurance last month provides a good deal of detail on the transaction structure, which we go into in Slack in further depth. The main proceeds of the transaction will go to a newly-created foundation for the benefit of Louisianan's, and the report submitted to the department of insurance highlights how little is known yet about how this foundation will operate.

Kevin's Reaction:

The department of insurance filing is a fascinating read for anyone looking to learn about how these types of transactions are structured, and you can see why if you're a state regulator you might be a little concerned.

For me, there's at least three interesting learnings in here. First, that a $3 billion foundation can be created as part of a transaction like this, without any real clue what said foundation will actually do. On the one hand, that seems understandable given the foundation doesn't yet exist. On the other hand, it seems like $3 billion is a lot of money to allocate to something that doesn't yet exist. Second, another portion of the payment for BCBS LA involves cutting checks to policyholders, which was a learning for me that something like that happens in a deal like this. Given that, why not just cut a check to policyholders for the entire transaction value, versus creating that foundation? Lastly, it was interesting to note as part of the purchase price that BCBS Louisiana was holding its risk based capital at 838%, even though the minimum requirement appears to be only 200%. BCBS Louisiana will actually be contributing $667 million to the foundation out of its RBC reserves as part of the deal, which would only reduce the RBC ratio from 838% to 500% - which seems to imply that BCBS Louisiana is sitting on $1 billion in excess cash in its RBC reserves. As was shared on Slack, it sounds like that may not be uncommon behavior and a result of insolvency issues back in the 1980s.

CHART(S) OF THE WEEK

Sharing a visual or two from the week that made us think

Source: Hiding in plain sight: The health care gender toll, Deloitte

Deloitte published an interesting report looking at the gender gap in out-of-pocket costs for health care. The analysis included 16 million lives across employer-sponsored coverage, including a mix of self- and fully-insured, as well as a range of employer sizes.

Casey Langwith's Reaction:

Casey Langwith is the CEO of a stealth women's health startup. Prior to founding the company, she worked in senior roles at various health tech startups such as Olive and GoodRx, as well as spent several years at McKinsey working in the firm's healthcare services business. She shares her reactions to the report's findings:

As illustrated in the chart above, women ages 19 to 64 paid 20% more than men in out-of-pocket expenditures on average in 2021. Given what we know about the wage gap, the fact that women are paying more for health care makes me especially worried that young women are at a steeper economic disadvantage than young men. Considering the downstream effects, this means young women will have less disposable income to put toward savings or mortgages, putting them in an even more precarious position as they age, especially since women tend to live longer than men.

Health insurers benefit from women being more proactive health care consumers than men, but Deloitte’s analysis shows women are effectively being penalized for good behavior. As Deloitte points out, the key categories of spend are radiology, laboratory, mental health, emergency room, office visits, physical therapy/occupational therapy, and chiropractic. The good news is: with the exception of ER and office visits, these categories are largely “shoppable”, i.e., viewed more as commodity services, which are easier for consumers to search for and compare prices. Companies offering these services should do more to appeal to women consumers specifically.

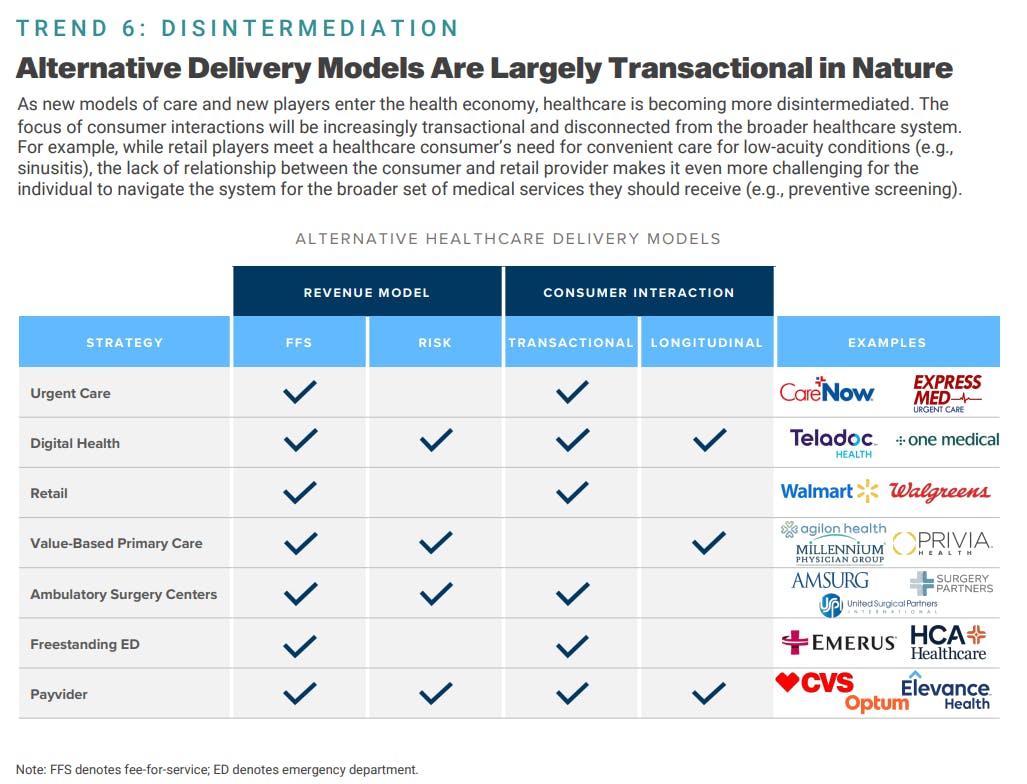

Source: 2023 Trends Shaping the Health Economy, Trilliant Health

Per usual, the Trilliant Health team put together a very insightful report on 2023 Trends Shaping the Health Economy. The report highlights and unpacks 10 overarching trends that will impact the US healthcare system - including the unraveling of physical & mental health, rising employer costs, overstated monopolistic effects of provider M&A, and more.

One finding that got us thinking in particular was the trend around healthcare becoming more disintermediated. As highlighted in the chart above, with new models and non-traditional players continuing to enter the health ecosystem, the nature of consumer interactions are becoming increasingly transactional and disconnected from the broader healthcare system. More tangibly, when you think about what a care interaction for a consumer looks like today at a retailer, the experience is centered more around convenience to treat low-acuity conditions. Given the transactional nature of the care experience, this starts to feel like a missed opportunity and potential concern for disconnecting patients from a broader set of critical medical services they should be getting - such as preventative screening.

OTHER NEWS

A round-up of other newsworthy items we noticed during the week

Virgin Pulse is set to merge with employer health platform HealthComp. It's another interesting example of an employee health navigation company expanding services in a way that looks a lot more like a health plan / TPA. From an asset perspective, this makes sense in that Virgin Pulse seems like the really nice consumer facing navigation platform that will now be bolstered by HealthComp, which is a TPA. A couple of things we're thinking about here: 1) As an employer who has both UHC and Blues as a TPA for its health plans, and Virgin Pulse or Transcarent as a navigator, you're probably starting to get really confused as to who is doing what and 2) As one of the traditional Health Plans / TPAs, you're starting to take a hard look at current customers with navigator partners that have been sticky, and if you haven’t already, expanding your competitive set beyond traditional and startup carriers.

Link / Slack (h/t Sam Lee)

Cano Health has sold the majority of its primary care centers across Texas and Nevada to CenterWell Senior Primary Care. The transaction value is nearly $67 million, consisting of $35.4 million in a cash payment and the remainder of the value comes in a release of liabilities owed by Cano. CenterWell will be gaining ~15,000 members as part of the transaction and Cano will get some much needed cash in the door. Cano will use a good portion of its cash on hand to repay its debt facility so it can meet its debt covenants.

Link / Slack (h/t Matt Poindexter)

Healthcare SaaS provider, Tendo announced it will acquire healthcare marketplace, MDsave at a reported $150 million valuation. The acquisition is aimed to extend Tendo's platform via MDsave's marketplace to help patients more easily find and schedule care options, as well as manage care in one place.

Link / Slack

Fitness tech company, Whoop shared it will be integrating a ChatGPT-enabled coach into its platform, called Whoop Coach. The new feature will provide customized workout plans, health recommendations, and more based on your activity data and wellness goals.

Link / Slack (h/t Ajmail Matin)

Costco has partnered with Sesame to provide the retailer's members with access to virtual and in-person appointments via Sesame's healthcare marketplace.

Link / Slack (h/t Bryce Platt)

Duly Health (formerly Dupage) appears to be struggling financially with the debt they took on as part of the Ares buyout. The article below suggests Ares might be looking to sell Duly if it can find a buyer. Would be interesting to see if any strategics would take it on. A couple that come to mind: 1) Seems like it could fit into CVS / Walgreens strategies, although not sure either of those make sense timing wise or 2) Optum is Optum. Beyond that, it seems like you'd be looking at a sale to another PE group. More broadly, it's interesting to see the struggles here - you'd think a multi-specialty group like this, with density in a local market would be as well positioned as anyone in the current climate.

Link / Slack

FUNDING

A collection of notable startup financing rounds across the industry

Cartwheel, a student mental health platform, secured $20 million in Series A financing. The company currently operates in 50 school districts and plans to use the fresh capital to move into 5 new states.

Link / Slack

Evvy, a vaginal diagnostics startup, raised $14 million in Series A financing. The startup provides at-home vaginal microbiome tests to consumers.

Link / Slack

Menopause startup, Midi Health secured $25 million in Series A funding to launch nationwide and expand health system partnerships.

Link / Slack

Doceree, a healthcare marketing platform, raised $35 million in Series B financing.

Link

Reply