👋 If you enjoy the free weekly newsletter, consider joining the Health Tech Nerds Community, a members-only Slack community designed for networking and knowledge sharing!

Sponsored by: Vanta

In an era where AI is reshaping how businesses operate, the journey of building an early-stage startup has never been more dynamic—or complex. How do founders find product-market fit, delegate, and scale, while adapting to rapidly changing technology?

Join Vanta on January 14 at 3pm PT for a fireside chat with Christina Cacioppo, CEO and Co-founder of Vanta, and Eric Ries, author of The Lean Startup and Founder of LTSE. They’ll cover:

Learnings from their own experiences

How the principles of “founder mode” and lean methodology intersect

The ways that today’s AI-driven landscape shapes early-stage growth and startup success

If you're interested in sponsoring the newsletter, let us know. Limited spots remaining for Q1!

A Reflection on the Week

Kevin here. Certainly, the healthcare news cycle picked up this week ahead of JPMorgan next week — a number of acquisitions, funding announcements, policy discussions, and the like. This newsletter is pushing 3,500 words and will get cut off in email. So if you’re on a flight out to JPM or whatever and want to read all of it, check it out in your browser.

I have to admit as I write this that I’m approaching all-time high levels of cynicism towards all this activity in healthcare that we think of as innovation is at an all-time high. Perhaps I’m not the only one feeling that way. I find myself more and more wondering what we’re accomplishing here.

I’m just not sure how to process all the contradictions that seem inherent in the activity in the sector over the past week. We have a national debate raging on about the wastefulness of for-profit healthcare, particularly insurance. Folks like Mark Cuban are taking the opportunity to weigh in with blog posts about getting rid of insurance and moving to cash pay as a key fix for the system. I find myself wishing that people would spend more than 90 minutes thinking about the topic before confidently suggesting solutions like moving to cash pay for people who can afford it as a solution to a deeply complicated dilemma we all face. This concept seems relevant here.

While that debate careens through the internet, we have AI startups raising hundreds of millions of dollars, with VC investors excitedly talking about how the financial opportunity is not just billions of annual revenue but hundreds of billions (!!!) of annual revenue. We have Eli Lilly, a drug manufacturer with a market cap of $755 billion on Friday, launching a new $500 million venture fund for AI drug discovery. For context: Eli Lilly’s $755 billion market cap is ~$40 billion more than the combined market caps of the following companies: UnitedHealth Group, Elevance, CVS, Humana, Centene, Molina, Oscar, and Clover. We also have a non-profit safety net provider flipping to a for-profit model after losing its shirt trying to manage financial risk (more on this below). We also have the WSJ musing about opportunities to invest in healthcare stocks despite the industry headwinds while also pillorying UHG for profit-seeking behavior that distracts from taking care of patients. It all just seems so deeply contradictory to me as we simultaneously talk about building platforms in healthcare while also talking about the need to break down platforms in healthcare.

I point out those examples — there are many more below — not because I think they are bad or wrong or inherently wasteful, but because I think they underscore the magnitude of challenge and opportunity we all have as we continue on this quixotic journey to “fix” American healthcare. In an industry that is pushing 20% of GDP and has been above 10% of GDP since the 1980s, I don’t think there are easy answers here. We’d have fixed it by now if a simple solution existed. Everything we collectively do is deeply flawed. Instead, I think we all have the opportunity to think deeply and critically about what is driving these problems and how we can play a role in making things incrementally better.

With that vent out of the way, onto the headlines from the week…

News That Made Me Think This Week

EMPLOYER M&A

Transcarent takes Accolade private for ~$621 million

General Catalyst and 62 Ventures (Glen Tullman’s other venture fund) agreed to provide Transcarent with the capital required to take Accolade private for $7.03 per share, implying a total equity value for Accolade of $621 million. The deal is expected to close in Q2 2025, and the combined entity will support 18 million members across 1,400 payor and employer clients.

The STAT reporting linked just below does a nice job summarizing the strategic rationale here — combining product offerings and growing the customer base at a reasonable price seems like a no-brainer for Transparent. For Accolade, it’s a logical change of environment after a challenging period on the public markets.

Read STAT’s reporting

Read Accolade’s April 2024 Investor Presentation

Read Accolade’s 2020 S-1

Read Accolade’s Communications with Employees / Partners - here and here

✍ Going Deeper

Accolade first went public in June 2020 at a $1.2 billion valuation. With the benefit of hindsight, it seems obvious that digital health valuations were nearing a high-water market at the time (Livongo’s $18.5 billion acquisition was announced in August 2020). At the time of the IPO, Accolade was trading at 4.7x forward revenue, which ballooned up to 8.0x in July 2020, a month after the IPO. It’s now being acquired for ~1.3x forward revenue (based on revenue projections from October).

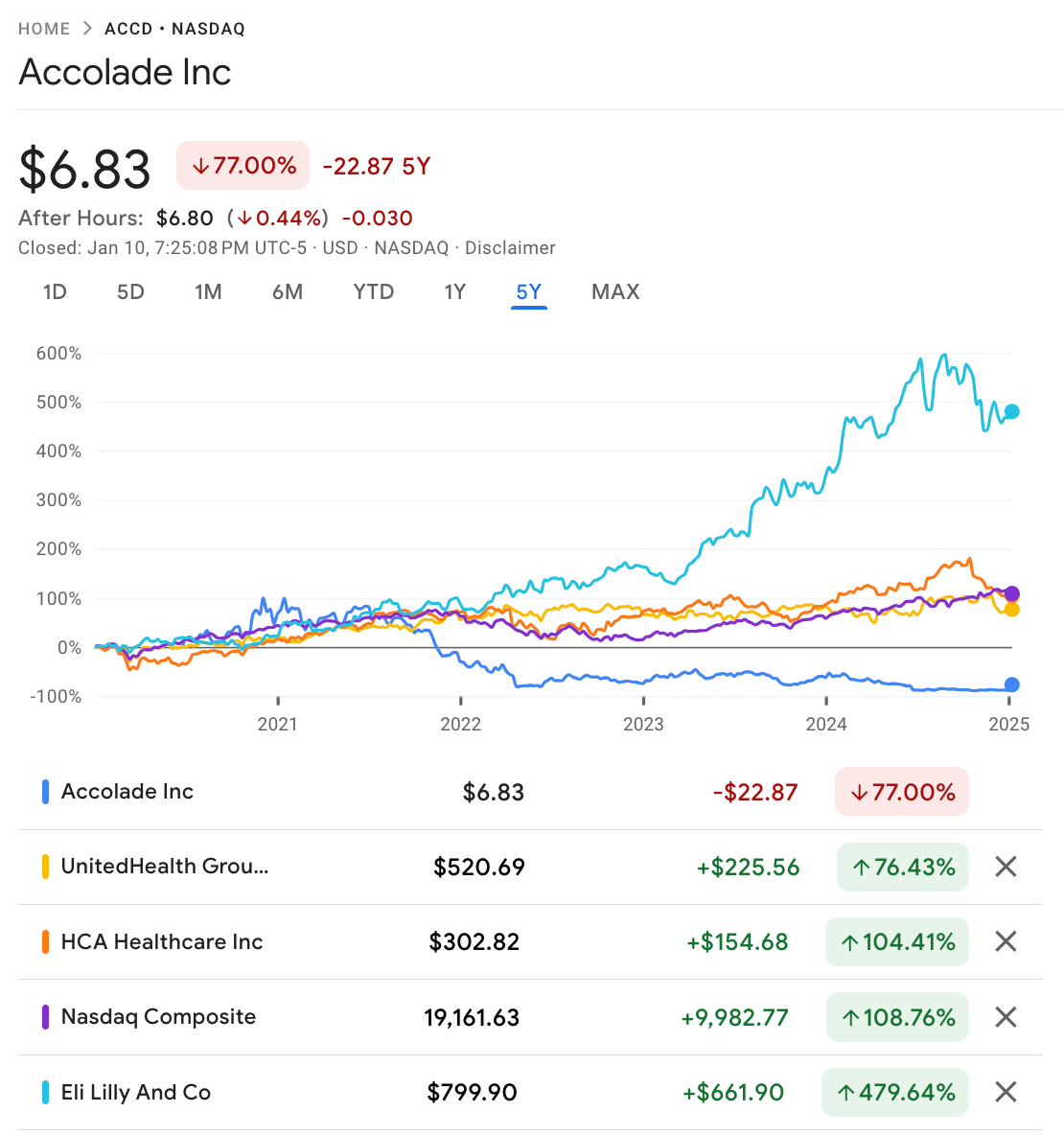

It’s a good reminder that the past several years have not been kind to the digital health sector on the public markets. You can also see this when comparing Accolade’s stock price performance to other leading healthcare stocks over the past five years in the chart below:

Source: Google Finance

Accolade’s stock price was hovering near its all-time low, and it had been stuck there for six months. This despite the fact that Accolade seems like it was executing relatively well strategically in a challenging macro environment — it had diversified away its revenue concentration risk after the Comcast loss in 2022, it was moving toward profitability in 2025, it was growing at a 30% CAGR, and it had made some meaningful moves in its product portfolio.

With all of that said, while this deal makes sense from a strategic perspective for all the product and customer expansion reasons covered elsewhere, it seems to say more about the state of the capital markets than anything else. Adding nearly $500 million of revenue across a diversified customer base in the employer market that is approaching Adjusted EBITDA profitability, all for the reasonable price of 1.3x forward revenue, seems like a no-brainer.

All-in-all, it strikes me as an astute move by Tullman and General Catalyst to acquire an undervalued asset that will provide a meaningful boost for Transcarent in its likely IPO narrative, whenever that comes to fruition. I’d be willing to wager that Accolade’s contribution to that eventual IPO will be valued at more than 1.3x revenue as part of that process. That seems like it is the endgame here.

VALUE-BASED CARE FUNDING

Oak HC/FT invests in Medical Home Network, a (formerly) non-profit VBC model for FQHCs

Medical Home Network (MHN), a non-profit dedicated to helping FQHCs implement value-based care models for Medicare and Medicaid populations, announced it raised funding from Oak HC/FT. It will transition to a for-profit public benefit corporation as part of that funding.

MHN initially launched in 2009, focused on providing care to Medicaid patients in Chicago. It launched the MHN ACO in 2014, a network of 13 FQHCs in Cook County that manage 165,000 lives. As we’ll get into more below, that ACO appears to have led to a healthy period of financial performance for MHN in the following years, which deteriorated rapidly in 2023 as it took risk in ACO REACH. Health risk assessments (which have received a lot of scrutiny in MA recently) are core to the models success, with the ACO citing an 86% HRA completion rate as a cornerstone to the model’s impressive clinical results.

✍ Going Deeper

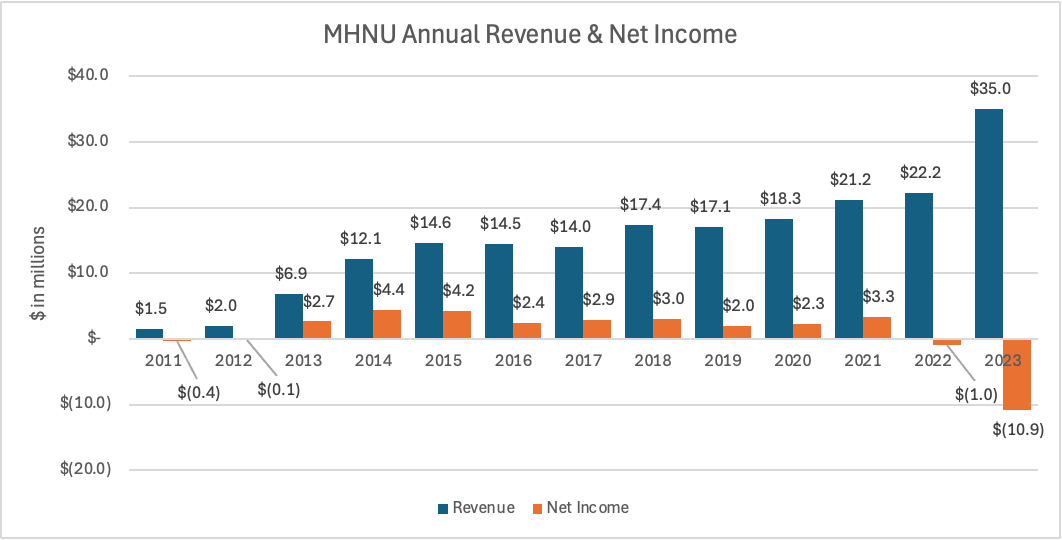

It’s interesting to chart MHN’s financials based on 990 filings since it started back in 2009. The chart below provides a high-level view of MHN’s performance over time, indicating it was relatively stable between 2013 and 2022 before significant growth in 2023 caused a meaningful financial loss for the organization. The loss in 2023 appears to be driven by a shared savings loss, according to the 2023 990 filing. Without the shared loss, revenue for 2023 would have been ~$44.5 million across management services, care management, and premium revenue, but Mhnu reported a ~$10.7 million revenue hit associated with shared losses in the year, which caused a $10.9 million net loss for the year. This comes after it generated between $2.0 and $4.4 million of net profit every year between 2013 and 2021.

Source: A chart by me using Propublica 990 data for Mhnu Corporation

I thought this was a helpful interview with the CEO of MHN back in 2020, discussing the recent history of ACOs for FQHCs (see this 2013 Commonwealth Fund case study that was referenced), how MHN was seeing positive clinical and financial results from its model, and future opportunities for the model. It makes me think about a few different things:

How well can care delivery models withstand transitions like this?

Based on a quick read of MHN’s history this week, it seems like a cool model of care that has demonstrated positive clinical and financial outcomes in an underserved population. In general, it seems like the more we all can do to support models like this, the better. But I also wonder how the model will hold up as it transitions from a not-for-profit to a for-profit, venture-backed model. That is particularly true when I look at the financial issues the organization appears to have experienced in 2023, which appear to have coincided with significant growth in managing risk on members in that year.

Presumably, MHN being a public benefit corporation will put in place some safeguards around the social impact that MHN will have, but I’m not sure what teeth those safeguards actually could have. The challenges that Innovage faced after transitioning from a non-profit to a for-profit PACE program back around 2016 come to mind as I write this. It provides a good case study for how becoming too oriented toward growth can negatively impact patient quality and safety. I am sure both MHN and Oak HC/FT will work hard to avoid these types of clinical issues while righting the ship financially and driving growth — it just seems like a question of what gives first if only one or two of those objectives are feasible.It’s yet another reminder that managing risk is hard, particularly at sub-scale population sizes

The podcast linked above discusses around the 50 minute mark how MHN launched a SNP plan in Cook County back in 2020. It appears based on CMS data that the plan operated for a few years, gaining <1,000 members, before winding down. In the podcast, MHN’s CEO referenced how hard Covid was on the model, and you can imagine that in a model heavily reliant on completing HRAs to identify member needs, that it would have been a challenging time to complete those HRAs, among other things. MHN reported generating a $1.6 million shared loss in the ACO REACH program in 2023, with a -0.5% net shared savings rate on 22,000 members enrolled in the program (per the CMS data). The data shared above in MHN’s 990 filings further calls its financial performance into question (and I’m not quite sure how to square the CMS data on ACO REACH performance with the data in the 990, which appears meaningfully worse in terms of the loss generated by the program).

Despite the underperformance here, I’d imagine concepts like the SNP plan and growth in programs like ACO REACH and MSSP are a central part of the thesis moving forward. I think you could also take that one step further — I’d imagine that achieving scale in those programs was probably one of the key narratives for the investment here as a way to turn around the organization's financial performance and drive upside at scale.How should we collectively think about funding the earliest stages of care delivery?

It’s fascinating to me that MHN has quietly been building an impactful business with an ACO supporting 160,000+ members as a not-for-profit in Chicago over the last fifteen years. It was started on the back of a grant from the Comer Family Foundation in 2009 to establish a pilot program for transforming healthcare delivery in Chicago. That story seems like a really good example of the type of innovation we all should be celebrating in this industry. Yet it goes unnoticed by folks like me because there are no press releases about Series A valuations or whatever (and finally, it gets noticed when there is a press release about VC investment). When I look at the financials above, I can’t help but see an organization that was delivering care — with a nice net profit margin — for nearly a decade between 2013 and 2021 that suddenly generates a massive loss in 2023 as it seeks to manage risk.

It invites many questions for me about how we think about defining the success of these models, what level of scale we should be aiming for in care delivery, the ability of providers to manage risk successfully, and how we celebrate success in care delivery innovation. Kudos to MHN for what they built, and hopefully they can navigate this phase to get back to that place.

Interested in sponsoring a meetup? Reach out! It’s a great way of getting in front of an engaged group of builders, operators, and investors across local markets.

Other Top Headlines From the Week

Walgreens announced its FY Q1 2025 earnings, with its stock jumping 27% as it meaningfully beat expectations for the quarter despite pressure in consumer spending. On the care delivery front, Walgreens noted in its prepared remarks that it is in the middle of conducting a sale process for VillageMD, and it will use any proceeds to reduce Walgreens’ net debt. Given Cigna’s decision in Q3 2024 to write down the value of its investment in VillageMD to $0, and the departure of VillageMD’s co-founder, CEO, and Board Chair in November, it seems safe to assume that the process has not gone well. I continue to have a hard time understanding why it is so challenging to get any deal done here. Interestingly, Walgreens also noted during the call that while the sale process is underway for VillageMD, it continues to evaluate options for Summit-CityMD. That seemingly would imply the two assets will be again separate in the not-too-distant future.

CMS issued its 2026 Advanced Notice for the Medicare Advantage industry on Friday. While I can’t claim to have fully digested the 181-page document myself, Bloomberg reported that it included a $21 billion payment boost to MA insurers for 2026. It is interesting to note the Bloomberg reporting that Democratic senators, including Elizabeth Warren, were pushing for Advanced Notice to be released a few weeks earlier than normal ahead of Trump taking office (there is precedent for this as Trump appears to have done the same thing in 2021). Given Warren’s general animus towards the insurance industry, it seems incongruent to see that MA stocks generally traded up after hours after the notice came out. Will be curious to see how this process plays out.

PE-firm New Mountain Capital is acquiring Machinify, an AI payments platform, and is combining it with its recently acquired payment platform. That platform resulted from a merger in September 2024 of The Rawlings Group, Apixio’s payment integrity business, and VARIS. Fierce Healthcare reports the combined entity will be worth $5 billion, with Machinify approximately $2 billion of that, and annual revenue of ~$500 million.

Virta announced it has reached $100 million in revenue run-rate on an annualized basis. It is growing 60% year-over-year, driven by interest in weight-loss and GLP-1s. If I’m doing my math right, that means it did roughly $8.3 million of revenue in December 2024, up from $5 million in December 2023, implying it likely did somewhere around $80 million in revenue in 2024. Virta also noted it expects to be profitable in 2H 2025.

UPS has quietly built a meaningful business in healthcare, as Bloomberg covers nicely here. Its healthcare business was $10 billion in revenue at the end of 2023, roughly 10% of overall revenue for UPS. UPS expects to grow the healthcare business to $20 billion by 2026. UPS likes the healthcare business as a path forward, with operating margins in the high teens versus 10% for the overall business.

a16z and Eli Lilly partnered to launch a new $500 million venture fund focused on drug development called the Biotech Ecosystem Venture Fund.

Blue Cross of California restructured and appointed a new CEO, the first women CEO in the organization’s history. Blue Cross of California’s new parent entity will be known as Ascendium. It will have three subsidiaries — BSC, Altais, and Stellarus.

Providence Ventures spun out of Providence Health System and is rebranding as Allumia Ventures. Providence has committed $150 million and will serve as an anchor LP for Allumia’s third fund, which will also seek other investors.

In news that likely would have been a bigger headline for digital health any other week, Ribbon Health is being acquired by H1. Ribbon had raised $55 million in funding from leading investors, including General Catalyst and Andreessen Horowitz. The deal is a combination of stock and cash for Ribbon, which was generating north of $10 million in revenue, according to the link above.

The Biden Administration announced a final rule to remove medical bills from credit reports.

Two private equity firms paid $1.1 billion to acquire specialty pharmacy and infusion provider Soleo Health from another private equity firm.

Clover continues building momentum, announcing a new partnership for Counterpart Health with Duke Connected Care, an ACO within Duke University Health System.

Behavioral Health startup Neuroflow has acquired an analytics model from Intermountain.

Featured Jobs

Director of Partnership Operations at Habitat Health, helping seniors remain at home by providing care and benefits through the PACE program. Learn more.

$150k — $165k | Hybrid (SF)

Sr. Associate, Business Development & Strategy at Habitat Health. Learn more.

$100k — $130k | Remote

Primary Therapist (Full-Time) at Overstory Health, a high acuity mental health provider with an Partial Hospital & Intensive Outpatient (PHP & IOP) model. Learn more.

$75k — $100k | On-site (Boston)

Group Therapist (Part-Time) at Overstory Health

$45 — $60/hr | On-site (Boston)

Data & Analytics Lead at Daymark Health, a value-based oncology care company. Learn more.

$175k — $200k | Hybrid (NYC or Boston)

Healthcare Fellowship (March - May) at Black Opal Ventures, a healthcare and tech focused VC firm. Learn more.

$1,000/mo - 5 hrs/wk

Contact us to feature roles in our newsletter.

Startup Funding Announcements

Innovaccer, an AI platform for providers, raised $275 million. Innovaccer cites six of the ten top health systems in the US as customers.

Hippocratic AI, a company building LLMs for healthcare, raised $141 million at a $1.64 billion valuation.

Evergreen Nephrology, a VBC kidney care provider, raised $130 million.

Qualified Health, an AI governance platform for healthcare, launched and raised $30 million.

Nema Health, a virtual PTSD treatment model, raised $14.5 million.

Fello, a new peer support model for mental health, raised $10.4 million.

TwentyEight Health, a virtual provider for women’s sexual and reproductive health, raised $10 million.

Grove, a clinical trial engagement model, raised $5 million.

Other Good Reads

A Insider’s Recipe To Navigating Your Prior Authorization by Speak Up for Your Health Podcast / Archelle Georgiou and Lee Newcomer

This is a fascinating podcast between two former UnitedHealthcare Chief Medical Officers about the state of prior authorizations. It’s interesting to hear them discuss how they view the pendulum has swung from back in the late 1990s when UHC make national waves for removing all prior auths to today when prior auths seem overused by insurers. It provides some really tactical insights into the prior auth process, and how both insurers and providers are responsible for issues in the process. Read more

What Town Hall Sees in 2025 Perspectives 9 Key Healthcare Shifts: From MAHA to Consumer Accountability to Pharmacy Reform and Beyond by Andy Slavitt and Andie Steinberg

This was a really well done version of a predictions piece by the folks at Town Hall Ventures, discussing key themes that we’re likely to see in 2025 and the implications of those themes. I’ve shied away from linking too many prediction pieces this holiday season as it feels way overdone this year, but this one I found was well worth the read. Read more

We are facing a crisis in healthcare affordability, but not for the reasons you may think by Seth Cohen

An interesting discussion of the challenges associated with the rise of HDHPs. Read more

Opportunities for Medicare Site Neutrality in 2025 by Joe Albanese

A good report from Paragon Health Institute, a think tank with meaningful influence on Trump’s health policies, looking at how site-neutral policies could be implemented. Read more

Medicaid Per Capita Cap Would Harm Millions of People by Forcing Deep Cuts and Shifting Costs to States by Gideon Lukens and Elizabeth Zhang

An interesting analysis of the impacts of limiting Medicaid funding. Read more

Why Medicaid cuts could be a ‘crisis’ for people with disabilities by Timmy Broderick

A helpful discussion in STAT of some of the changes and challenges we might expect ahead in the Medicaid market. Read more

Want to share feedback with us?

Show your support by sharing our newsletter and earn rewards for your referrals!