- Health Tech Nerds

- Posts

- HTN Deep Dive: Medicaid Market Entry Playbook for FQHC-Enablement Startups

HTN Deep Dive: Medicaid Market Entry Playbook for FQHC-Enablement Startups

A practical playbook for evaluating Medicaid markets and what criteria should be considered when the end game is to support FQHCs.

Hey everyone — Claire here!

Welcome to the first edition of my HTN Deep Dive series. I’ll be using this space to dig into interesting questions, ideas, and challenges that come our way—whether from startups, operators, or others in the community. The goal is to offer a thoughtful take, highlight what we’re hearing from smart people in the space, and hopefully spark some good conversation along the way. If you’ve got big questions or just want to bounce around some ideas, fill out the form at the bottom of this post!

A startup recently reached out with a great question: “What should we be thinking about when deciding which Medicaid markets to enter?” They’re focused on helping Federally Qualified Health Centers (FQHCs) improve their financial and operational performance.

To help them (and others thinking about the same thing), we pulled in insights from folks in our community (huge thanks!) and others deep in the Medicaid space. The result? A practical playbook for evaluating Medicaid markets.

It breaks down the key things to look at—market need, policy environment, payer dynamics, FQHC readiness, and regulatory fit—into a framework that makes it easier to figure out where (and how) to go to market.

Key Evaluation Criteria and Strategic Considerations

1. Market Characteristics

Core Question: Where are FQHCs most underserved and overburdened? Where is the need most urgent?

Size & Penetration: Are there enough FQHCs with sufficient Medicaid volume to support a viable pilot or scale effort? Prioritize states with large base of FQHCs and high Medicaid penetration.

Population Mix: What is the payer mix (Medicaid, Medicare duals)? Is the population rural, urban, or both?

Access Gaps: Are Medicaid patients seeking care out-of-network or out-of-region? Look for signs of unmet demand.

Service Offering: What services do the FQHCs offer? Behavioral Health, oral health, chiropractic, etc.

2. Policy & Political Environment

Core Question: Does the state have a track record of piloting or scaling Medicaid innovation? Is there a path to sustainability?

Medicaid Expansion: Has the state expanded Medicaid under the ACA? Look for states that offer broader coverage and payment models.

Innovation Support: Are 1115 waivers or APM (alternative payment model) pilots in place? Note, most APMs that apply to FQHCs tend to be professional-risk / professional-fees only.

Political Climate: Blue states may favor equity and VBC; red states may prioritize cost containment or administrative simplicity. Consider ideology as it shapes policy and funding.

3. Payer & MCO Dynamics

Core Question: Who are the top 2-3 MCOs, and do they have a history of collaborating with providers or tech partners? If not, is there a viable path to MCO partnership, revenue, or scale?

Payer Landscape: How concentrated is the Medicaid managed care market (e.g., dominated by Centene, Molina, UHC)? High concentration could mean fewer contracting paths.

VBC Appetite: Are payers actively pursuing partnerships with FQHCs to meet quality or equity goals? Look for active initiatives.

Contracting Complexity: Are there multi-payer opportunities or dominant MCOs that could ease scale? Centralized quality measures could potentially ease scale.

4. FQHC Landscape

Core Question: Where can we create the most value quickly by filling a capability gap?

Size & Readiness: Are FQHCs large enough to implement transformation but small enough to need help?

Fragmentation: Is there a central network, IPA (independent practice association), or association that can accelerate partnerships? Note: most FQHC networks within states are called, ‘Primary Care Associations’ aka PCAs.

Technology & Infrastructure Gaps: Do FQHCs lack tools for population health, care management, or reporting? Common areas of need include care coordinating and data reporting.

5. Financial Viability & Regulation

Core Question: Can we operate compliantly and profitably within the state’s reimbursement and regulatory framework?

Reimbursement Strength: What’s the Medicaid-to-Medicare payment ratio? Higher the better.

Supplemental Funding: Are FQHCs eligible for stable wraparound, DSH, 340B, or GME funding? Note: many FQHCs rely heavily on Grants. Heavy reliance on Grants will be something to note due to vulnerability with funding cuts and political changes.

Legal Fit: Does the state require MSO/friendly PC models due to CPOM laws? What are the CPOM laws?

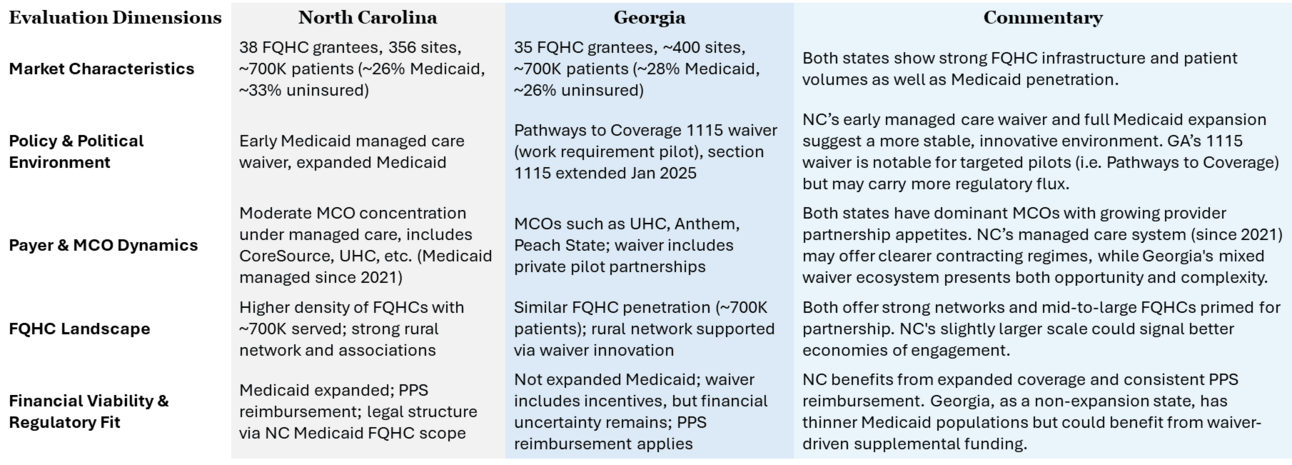

Example state by state comparison using the evaluation framework as our guide. The results revealed clear differences in strategic fit across markets- especially in policy alignment, MCO dynamics, and FQHC infrastructure.

Additional Resources to Explore

Explore this Medicaid market entry webinar for state-specific strategies, FQHC readiness signals, and go-to-market tactics.

Have a question you want us to answer?

We love talking with startups, investors, and corporate teams that are working on building cool things in healthcare. Whether you’re figuring out your go-to-market plan, exploring new business models, or just trying to make sense of the space, we’re here to help. If you’ve got big questions or just want to bounce around some ideas, let’s chat. Fill out the form below and we’ll take it from there!

Reply